Jun 04, 2025

Tesla is unique company. They make electric vehicles, robotics and also have a thriving energy storage business.

Fundamentals-based investors get squeamish when they dig into Tesla's financials. The valuation of Tesla often

struggles to hold up against its actual fundamentals. Because of this, a 50% drawdown is not uncommon for the stock.

My theory of Tesla stock is that you can't look at it this way. It is a "story stock", with levers in AI, autonomous driving robotaxis and the transition to renewable energy backing it. Tesla trades on vibes and stories.

They are a profitable at a time when the electric vehicle (EV) movement is pumping the brakes. Long term, I believe Tesla will be competitive in EVs, but it is getting tougher for them with more competitors entering the market.

Tesla had the "first mover" advantage in EVs and parlayed it into a profitable business with many potential new levers of growth. Nowadays, it is a more risky bet given how its valuation has swollen since 2019. I have sold down the position to below a 10% allocation in my portfolio to hedge my downside risk if robotaxis don't pan out. I wouldn't recommend the stock in 2025, given what I've known from being an investor for 6 years. But could there be more money to be made on the stock? Ultimately, that's what investors want.

My point is that Tesla is its own animal. Someday, it will likely be thriving in robotics and autonomous driving. When you consider Tesla as an investor, you need to consider the vibes and the story. Admittedly, it is risky to invest this way. That's why more disciplined investors have scoffed at its prospects as an investment ever since I first bought the stock 6 years ago.

With Tesla, you need to look at the company wholistically. Watch where it's heading in the long run. Stay invested for the long run. This has been the pattern historically that has paid faithful investors, but past returns are no indication of future results. You need to read the vibes and put the fundamentals on the back shelf if you are researching Tesla.

Jun 02, 2025

I am always learning in investing. Recently I've been reading into different cases of optimizing assets by keeping them in the right account. Placing different assets in the proper type of account can have a huge impact on your net worth down the road by reducing your tax bill. Certain assets are best suited for a 401(k), some for a tax advantaged Roth IRA and the rest into a taxable brokerage account.

Six months ago, I decided I wanted to invest in a REIT (Real Estate Investment Trust) to diversify my portfolio into real estate. By owning a REIT, you collect the income from a portfolio of rental properties.

I chose to invest in Realty Income (O). It yields a monthly dividend, which I've reinvested back into my position. So far, it's been a steady place to keep a 1.4% position size in this turbulent year. As of today, I'm slightly in the green in profits. In their Q1 earnings report on May 5th, Realty Income mentioned it is the 7th largest REIT globally. They also pointed out that they have 98.5% portfolio occupancy, so nearly 99% of their properties are being actively rented.

"We owned or held interests in 15,627 properties, which were leased to 1,598 clients doing business in 91 industries."

- Q1 2025 Realty Income Earnings Call

Reading online, I found that REITs are required to pass through 90% of their taxable income to shareholders. This gives them a different tax classification. The dividends REITs yield are "non-qualified dividends" which are part of your taxable income. This means that REITs are best suited for a tax advantaged account like a Roth IRA to keep more of your dividends.

Before I discovered this REIT tax nuance, I bought Realty Income in my taxable brokerage account. Now, I'm contemplating how I will shift my REIT holding into my Roth IRA. From what I've researched online, I would need to sell the position and re-buy in my Roth IRA. It is ok to keep a REIT in your taxable brokerage if you want to yield money you can use immediately.

However, the tax hit on your dividends will be substantial in a taxable brokerage account. You'll also pay a higher tax on the dividends if you earn more from your salary or business, depending which tax bracket you fall into.

For new investors, the key concept here is that certain assets are better suited for your tax advantaged accounts. Another example of this that I realized recently is that holding bonds in a Roth IRA negates the tax advantage of the Roth. Bonds are best suited for a 401(k).

In the case of REITs, they are subject to higher tax rates versus typical dividend stocks. Therefore, if you want to invest in a REIT, you can keep more of your gains over the long run and maximize compounding by putting your REIT in a tax advantaged Roth IRA.

May 30, 2025

After the post-market session closes for the night, I tend to check in on the market at night in a few different places. Foreign markets, overnight markets and futures offer a look at what the market might do next. Here are my go-to spots to check the market's pulse after dark.

Checking Investing.com futures is a good signal for coming market reaction to news headlines. It's not a sure-fire indicator of how tomorrow will trade, but it usually gives a good hint at how the market will open up when news breaks.

- Robinhood Overnight Market

Most stocks now trade on an "overnight" market, which can be seen when checking Robinhood after 8 PM American Central Standard Time. You can check in on the more popular stocks to see how they're trending overnight.

Germany, Japan and Chinese markets may give hints about what is coming tomorrow. If Nvidia stock trades up in Germany, it will likely do the same here. If Nintendo trades up in Japan, its American Depository Receipts (ADRs) tend to see the same price action. I am holding a Japanese growth stock ETF, RAYJ. So I often check a watchlist of stocks I hold through it most nights at 6 PM CST when the Japanese markets begin trading.

Bitcoin sometimes does act like a tech stock. A reaction move in Bitcoin often foreshadows what tech stocks will do. Other times, it moves inversely to stocks completely, similar to gold. Therefore Bitcoin's price reaction is often a leading indicator since it trades 24/7.

These indicators are not something I check every night. Occasionally, when some news breaks, I might check these places to guage what kind of reaction is coming.

May 26, 2025

I've been buying and selling stocks for about 8 years. In that time, I've mostly bought and held.

Occasionally I will prune my stock portfolio. Sometimes the stocks I sold moved further down in price.

On 3 occasions, I've sold a stock and it went on to achieve greater than 100% return. It's painful for me to review,

but I think it's a healthy exercise to review your mistakes and try to not repeat them again.

I decided I didn't want to invest in the "next Starbucks". Even though the business is growing healthily, I decided

I prefer other opportunities. People seem passionate about their Dutch Bros drinks. I misread the stock and could have doubled my money if I bought instead of selling out in 2024 at $29.50 for a measly $7 profit.

One of my first stock picks was a good one in hindsight. However, my inexperience caused me to doubt the future of this sandwich shop chain. Checking back 5 years later, I was shocked to see how the stock had done. I sold the bottom at $2.89 in 2020. If I had stayed the course instead of bailing after 4 months, I would have tripled my money within 5 years. Instead I sold out at a ~$300 loss, flushing away what would have been a $1,700 gain today at the current price of $9.88.

I only held one share of Palantir for 6 months in 2021. I saw the stock constantly being discussed online and threw in $23. That share is now worth $124. Their dependency on government business contracts seemed a turn-off to me. I sold. I get that now they have the AI story as well. This is a promising company for sure, but I won't be purchasing shares at such a high valuation. At least my S&P 500 position gives me some exposure to Palantir's upside, so I caught the gains since they were added in September 2024.

Nobody Gets It Right Every Time

My read on these stocks was incorrect. I could have made money in them if I worked up more conviction. However,

sometimes I just feel a stock is not the right type of business for me. I am not interested in what Palantir is doing.

Also, there's no guarantees Dutch Bros will make it, but it seems they're executing at a high level currently.

I'm happy for these businesses to succeed. Potbelly was not an obvious winner stock to me, but now I can see with the benefit of time, it actually beat the market. It appears they're doing something right. Those are the types of unexpected winners that stock pickers dream about.

May 22, 2025

Occasionally, you will be holding stocks that you should sell. It is not always going to work out when you sell. I've also sold 5 stocks that went up >50%. Most times, you should hold. But this only works when the business is executing its plan and reaping profits. In some of these trades, I got out at a profit before the stock moved down. In others, I took a loss to move on from a bad decision, and then the stock continued to lose more than half its value.

I entered Krispy Kreme Donuts for a short term trade to medium term investment. This was an ill-fated move. I instantly became a bagholder from $13, bought the dip a few times under $10. After seeing my questionable pick, I sold half of my shares early in the trade at a loss at $10.45, a good move in hindsight. Still, I bought the dip when the price dipped below $9. After 3 quarters of following the earnings reports, the donuts started to smell a little funky to me. Add in that the brand is not owned by its original owners, but a venture capital firm who bought them privately to then return to flounder in public markets. The business isn't as hot and fresh as its donuts. They failed to turn a profit in this most recent quarter and the past 2 reports stunk it up. Management put a lot of its chips in the McDonalds partnership growth lever, which seems to have fizzled out. My losses were sizable, but thankfully I had the sense to get out at $6 before this tumbled below $3. In total, this little maneuver cost me $1,382. I would be in worse shape holding my Krispy Kreme bags today, given the state of the company and diving stock price.

This company was a short-term trade of which I knew so little about the company, Teradata. Traded a small $100-$150 position and closed at a small profit. Really not sure why I messed with this stock. It was a good move to kick it out of my portfolio, seeing it has lost half its value looking back to when I traded it.

Under Armor was one of my first stock picks. It was a terrible pick. I was only invested in the stock for 4 months. I felt the general sentiment was awful around their earnings reports. 2017 was a difficult year for the company. I sold out of my 30 shares in 2017 above $14 at a -22% loss. I couldn't justify choosing this company over Nike and didn't have much conviction due to negative operating sentiment. Suffice to say it's been a rough decade for athletic wear stocks. Looking back, with more patience I could have waited a few years to sell at breakeven or a small profit. However, checking back 8 years later, the stock is worth $6. Staying long UA from 2017 would have been a negative ROI, with more than half the investment value lost.

I wrote in an earlier post on this blog about my wise move to exit at $35-$55. The price currently sits at $16. In their case, it didn't pay to be

number 2 in the rideshare industry. More competition ramps up soon with Waymo delivering 250K rides

and Tesla beginning its rollout in June. I closed out my Lyft position for a $600+ loss. Similar to Krispy Kreme, I took the losses to lower my taxable income. In both stocks, I would be sitting on much larger losses if I kept my shares.

In the boom times of 2021, I impulsively bought the dip on the company that made Clubhouse. I bought Agora stock during Clubhouse's 15 minutes of fame moment after the pandemic. Remember Clubhouse? It's an audio service that offered live community chat audio rooms. It was not a good stock to hold since 2021. Fortunately, I kept my losses limited to $194, so it's not as deep a flesh wound as some other stocks have made. The stock has been sliding downhill ever since I got in above $90 and added on further drops. In the end, I tax harvested the losses and sold out at an average of $7. The current price is $3.59 so this beaten down stock did have room to fall even more. It was an odd bet to make that I didn't really think through. China exposure adds more risk here also. I think the lesson from this trade is that when a stock is having a moment of ultra hype and fame, don't get caught up in the flurry too much. I believe that is what happened to me when Clubhouse was having its moment. I also, being a developer, was attracted to the ticker "API". I thought I saw something disruptive happening in the audio space. The better audio investment choice would have been to add to my Spotify position. Fortunately, I don't often treat the stock market like a casino, and when I do, I typically don't bet a lot.

I wanted to invest in the marijuana boom, and Canopy Growth was one of the best known options to play the trend 5 years ago. This trade is runner-up for my worst investment outcome. The business is run like it's management's own personal credit card account. They're nowhere near profitable, and no signs of a turnaround. I rode this stock down too far and made the mistake of adding when it tanked. In the end, it was a $1,052 mistake that cost me most of my investment after holding for 3 years. The silver lining is that I did sell at a local high exiting at $7 before it dropped another 76% to below $2. I was so sick of this company by the time I sold, I felt a huge relief to no longer be holding. Good riddance.

I entered Match Group thinking it must be a high-margin business. It holds my personal record for the shortest time I've ever held an investment at 1 month and 3 days from open to close. Tinder, Hinge, Match.com and OKCupid are pinnacles of single dating life. Match Group has the market cornered it seems. However, I had no conviction in the idea nor the interest to understand the economics of dating apps. Then consider the fact that a dating app that does its job, connecting 2 people to start a relationship, causes Match to lose 2 users everytime it succeeds. In retrospect, it was the right move to move on from being a dating app investor. I sold my 3 shares at an average of $158 to cash in $5 of profits before the bottom fell out of this stock. It now trades around $29. Sometimes the best wins are the shots you don't take.

Eventbright was a well-known startup in the ZIRP era. They pop up occasionally in ticketing for events I attend. I only owned 1 share, which I bought and sold above $20 for a tidy $0.67 profit. The pandemic was a huge setback to their business and the stock reflects that thesis today. The market price as of today hovers around $2.

Beyond Meat rode a wave that turned out to be more of a fad. Veggie meat pops up occasionally at the restaurant. There are other products in this category, but it seems the demand for this type of food was overestimated. The position was small, 7 shares. Thankfully I didn't hang onto this one. I closed out the position at a $114 average for a $138 profit. I sold because it was low conviction to believe in the fake meat industry. Today it is priced under $3, so I made the right call to get out.

It's not often you will sell a stock and it actually ends up going to zero. I now can now tell the story of accomplishing this rare feat and have a little chuckle about the disaster. Foolishly, I was playing a trade for a bounce in a scooter company. This is my dumbest trade/investment idea ever. I simply didn't know what I was investing in. I saw some "merger" news that sounded bullish for them to become the largest scooter company in the USA via an acquisition of the scooter startup "Spin". "Why not own the #1 scooter rideshare company?", I thought. I had seen both Bird and Spin operating in cities like Denver and St. Louis. So I threw $200 in on a whim. The "news" (stock pump piece) of them becoming the #1 biggest scooter company in America was actually a precursor to "restructuring" and bankruptcy. I ignored the warning messaged from my broker not to buy the shares and bought in, looking for a comeback story. Bad news hit days after I bought shares. The company was delisted from the New York Stock Exchange for having too small of a market cap. The ticker moved to over the counter (OTC) exchange and the ticker was later changed from BRDS to BRDSQ. I averaged down on my shares on the OTC, hoping to break even.

"We firmly believe that BRDS current market cap does not reflect the intrinsic value of the Company," Michael Washinushi, Bird's interim CEO, was quoted as saying in the statement on Friday. "And while disappointing, this change in our listing status on the NYSE does not alter our commitment to our shareholders, our valued employees across Bird and Spin, our partners and the many global cities and institutions with which we work."

/- CNBC, https://www.cnbc.com/2023/09/22/scooter-company-bird-delisted-from-nyse-will-trade-over-the-counter

The message from the business was that they were staying the course, rebuilding with the Spin acquisition, and "committed to our shareholders". It turned out the acquisition was a facade to hide Bird's rotten core. After getting some skin in the game, I was eyeing the upcoming earnings call to learn more about what was going on with this mysterious business. Little did I know, the executives had no intention to host the call. When they made a surprise late night blog post announcement to "restructure" assets and reconcile with creditors, I set my sell order. I didn't want to be left holding the empty bag. Thankfully I had subscribed to the company website via RSS feed so I immediately saw the news. My final trade executed at open at $0.26 to sell 500 shares I had bought anticipating a recovery. After I sold it all, that day it plunged to below $0.10. I managed to get out at a -79% loss, losing $490. It was small bet that resulted in stunningly huge % short term losses in only 3 months from open to close of the trade. I deserved it for not doing my homework.

By selling at open the day after the bankruptcy news broke, I avoided the fall to zero and walked away with $129. Bird Global is no longer a publicly traded company, and no value was returned to shareholders due to all assets absorbed in repaying the scooter company's creditors. I still see their scooters in operation occasionally when I visit random cities. They have likely been absorbed by other scooter companies if they are still running or are still operating some places. The website still is live. If you search Bird scooters in the news, you'll see various cities are still kicking them out of town to this day. It's a constant reminder to me that good stocks will work for you and the worst stocks actually take from you.

Mar 11, 2025

2025 has begun with a bang and a pop (of equities). The new US government administration seems

hellbent on torching the portfolios of investors in the name of "short term pain".

The uncertainty of the situation has cast a dark shadow over the stock market. Maybe the market was overly frothy after 2 years of

excellent returns. The policies of the government seemingly exacerbated the situation to create a sense of dread over the

business world. Tariffs mean change. Businesses will need to adapt, possibly raise prices, and sales might be affected.

The stock market is pretty good at finding a catalyst to move in the direction it feels, and Trump became that catalyst.

This seems to be a case of overhyped expectations crashing to reality. When President Trump was elected in November,

the initial reaction was to forecast blue skies and green pastures. The man who took office has not delivered on that lofty,

euphoric and evidently misguided vision. Or maybe he will, but it will take some time.

The problem is that "short term pain" is very frightening to investors. How long is short term? How much pain will there be?

We don't have the answers. We don't know how this will play out. There may be some industries and countries hit harder than others.

Some companies will pay the price for Trump's trade war. Some people will literally pay more money for the things

they want and need because of these policies and the clumsy manner in which they are being rolled out, delayed

and retracted as bargaining chips, inciting our allies and opponents alike.

If we are truly long term investors, we should not change our strategy because of the tariff environment. However, I have taken

some chips off the table because of what has happened. I have not changed my core strategy, but I did close out 1 underperforming

stock at a loss. It was in the retail sector as an international brand that specifically has the name "American" in it.

I suspect there could be animosity towards American branded products in other countries. There is the possibility

that some countries around the world will see our president's actions as distasteful and choose not to buy American products.

Who knows if this will come to fruition, but it already seems to be the case with brands like Tesla noting sales dropped

considerably in Germany and Norway in recent months.

I also took a few bites out of some long term holds that are more susceptible to retrace their multi-bagger gains in this environment.

However, I only sold a marginal amount of my positions to help pay my tax bill and living expenses. I'm still long with the bulk of my shares.

All the tariffs are done to balance the trade deficit of the USA. As a fiscally conservative American,

I appreciate the motive behind these tariffs. I want us to close the trade deficit. However, the way we're going about this is disappointing.

I am not changing my investing strategy, but I am bracing for a rough year. I hope it won't be that painful, but I'm prepared to ride it out

for those long term gains we've been promised. We hate the uncertainty, but that doesn't mean we quit investing.

Feb 19, 2025

-

r/Wallstreetbets

-

r/Stocks

-

r/Investing

-

r/StockMarket

-

r/cryptocurrency

-

r/PersonalFinance

-

r/bogleheads

-

r/ValueInvesting

-

r/ETFs

-

r/DividendStocks

-

r/fire

-

r/SwingTrading

Feb 15, 2025

I love to talk about stocks: stocks that made me money in the past, stocks I'm holding now and stocks I may buy in the future.

However, it is not always going to work out sharing your ideas with friends, family or people you know. The reason is that you can't share your conviction to hold when the price dips. Paper hands get shaken out. You may have diamond hands, but not everyone will be able to wait until the diamond is fully formed.

People panic. People don't understand what they're invested in. In conditions where asset prices are dipping, they cave in and sell.

You can lead a horse to water, but you can't make it drink.

This is why you can't really talk about stocks with the average joe. They won't stay in the game long enough to win. Or they'll take profits too early.

Even in something as proven over time as the S&P 500, people will start to doubt it unless they are seasoned investor.

Sometimes, we need to cut our losses in investing. Other times, we just need to wait longer for a rebound. When faced with this circumstance, being able to discern which right road to take is never guaranteed.

The truth is you can't help someone become a great investor. They have to earn it. I've realized not everyone has that in them and that's ok. Those people are best suited to buy index funds or real estate. You can share stock ideas with people, but you won't always be there to reassure them to hold

through the tough times. I've fallen victim to my own miscalculations and sold at the wrong time. It happens. If you get your investment moves right consistently enough, the times you messed up won't matter as much.

As someone who was fortunate to have some early success with stocks, I wanted to share my thought process and what worked for me.

I started this blog for the sake of sharing openly how I process my investing journey. Nothing written here is financial advice.

It is a window into my own mind of investing that I choose to share. Could be useful or not. Ultimately, you can't make someone believe in stocks.

They have to realize the belief themselves. Stocks go up over time. Will you stick around and bet on that or take your ball and go home?

Jan 22, 2025

In investing, we get it wrong sometimes. It's called being human. Investing in single stocks is a constant reassessment. Just because you made a mistake in the past, doesn't mean you have to live with it forever.

In the past, I treated my Netflix (NFLX) position like a trade. I took some profits above $500 in 2021. Life was good. Foolishly, I began to doubt the security of the business when the stock suffered a 60% drawdown in 2022.

I always thought I had strong conviction to hold through bad times, but I'd never seen a stock move like Netflix did in 2022. And it wasn't just Netflix that suffered that year. Most of the stocks in my portfolio went through corrections or more extreme drawdowns. I started to look at each of my stocks and think, which of these can I really trust? I was a bit scared of seeing more stocks sell off. It definitely affected me psychologically to see my frothy gains of 2021 slowly disappear by the end of 2022. In hindsight, this was the time to buy. I did buy a lot back then, but also made some mistakes. One of the biggest being Netflix.

While I saw my portfolio under siege that year, I began to doubt how safe of an investment Netflix was. I lost sight of the big picture. Then I was thinking about how my position of 5 remaining shares was more than cut in half in a year. I started viewing my shares as a trade in terms of dollars rather than a company I own for the long term. This was my undoing. I believe this tension exists in the stock market for all of us. Am I a trader or an investor? That is decided by every move you make, buying or selling over time. In this case I was an investor who became a trader due to the extreme circumstances of losing money. It's an internal battle we all must be aware of when we buy stocks.

Subscribers growth was falling, basically only for one quarter. (Another rookie mistake, putting too much emphasis on one quarter). Now the company says they won't even report quarterly subscriber numbers. Wavering subscriber number worries were the main reason I felt uncertainty. Now the company is shifting to focus on profitability.

By 2023, 3 years after getting in, I had lost my conviction. I sold out my last Netflix share at $375 because I needed extra money and took a little last sliver of profit.

I no longer believed in the fundamentals because the stock price took a dive. For the first time in years, the growth was in question. Then, of course, it recovered. The stock went up 2-3x after I sold. It's been a hard lesson to learn. The silver lining is that the experience I gained might help me invest better in the future. Sometimes we lose sight of the big picture. Sometimes we flip from bull to bear. It happens.

When I was in business school, we'd read case studies about Netflix and how they changed the media game. They started as a mail-in DVD company and adapted into streaming. It's a great story. I have a hypothesis that the companies that make the right moves that get written about in biz school case studies are the companies you want to own, as long as they're still dominating their market.

Recently, the price skyrocketed over $100 in single trading day. Their recent Q4 earnings report showed strength. An impressive subscriber growth beat, price increases and growing live sports are positive catalysts. The big picture looks great for this company and they are growing on many facets. The difference is I was holding the stock again. It felt great to see the earnings report send shares soaring.

A month before the Q4 2024 slam dunk earnings report, I bought back in for 3 shares at $911. I decided I couldn't be on the wrong side of history anymore. I don't know what's going to happen next, but I know I want to own Netflix. This company is making the right moves. My gains aren't as big as if I had held onto my original lot, but it feels good to have some Netflix gains again. I see the big picture. This time if the stock drops big, I'll be buying more.

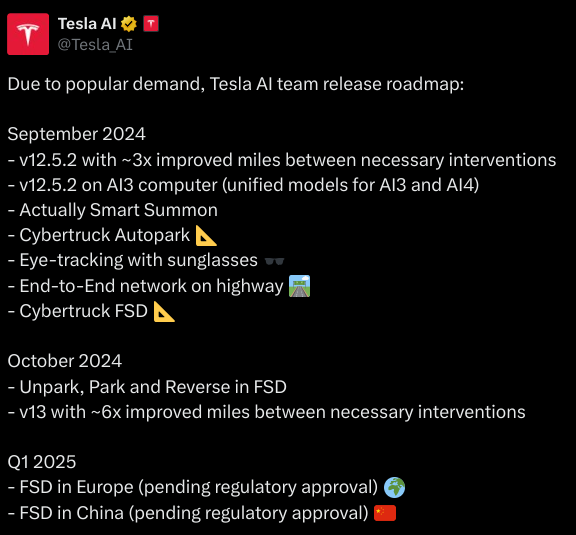

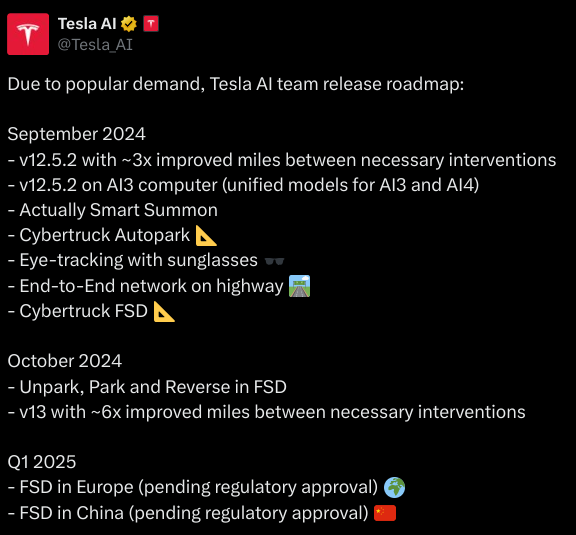

Sep 05, 2024

When I began investing in Tesla (TSLA) in 2019, I bought the stock because I believed in electric vehicles. They made sense to me. Someday, we'll be out of gas. We'll need electric vehicles. Stocks go up in the long run and demand for electric vehicles will grow in the future, so I made it a long term investment. I've been lucky enough to lock in multi-bagger profits along the way. Today, I am still heavily invested in the company. It's still my largest holding, at 17% of my investing portfolio.

Tesla cornered the EV market in the early 2020s, growing its sales impressively. My stock soared. Tesla was overbought in 2021, before the EV wave fizzled out with interest rates jacked up. The stock's value was cut in half midway through 2024, 3 years after topping out during the pandemic money printing run. These days, electric vehicle sales are decelerating. Other automakers struggle to sell them profitably. Despite the Cybertruck being the best selling $100K+ truck, Teslas are less exceptional nowadays than they used to be. People who want to buy electric have other options besides the Model 3. But they still have a competitive advantage over legacy auto. China is a different story. Most likely, the government will tax the Chinese vehicles to help out American EV makers.

In 2024, the company finds itself heading down a new road: autonomous vehicles. Elon himself said on the earnings calls, if you don't believe vehicles will drive themselves someday, sell the stock. The rise of the robotaxi is now what we investors are told to wait for.

A bet on Tesla is a bet on electric vehicles, robotaxis and some additional moonshots. In order for the stock price to hold up, they need the Cybercab to be unveiled and they'll need to grow other revenue streams.

Tesla changed the world by being the first profitable pure electric vehicle maker. The trillion dollar question is now... can they change the world again?

They have a convincing product with Full Self Driving (FSD) seemingly improving every month. But what are the real timelines we'll see for autonomous vehicles? Teslas may also face opposition from other motorists on the road. If no one is driving the car, will other drivers accept Teslas driving on the road and not interfere with them? Will lawmakers allow these cars to run the streets?

Waymo is already active in a small grid of California and Baidu (BIDU) is assisting Tesla with mapping in China. They also announced their Uber partnership is expanding to Austin and Atlanta. Will the world continue to shift to AI vehicles?

Despite the uncertainty of this line of new autonomous business, we should not count Tesla out. It's a company with many irons in the fire that could yield profits in the future. For example, 46% of Q2 net income came from Tesla's energy business, not from EVs. It also claims it's now using its Optimus robot in production.

I'm not sure what the probability is that Tesla succeeds in autonomous vehicles. Because of this uncertainty, I've trimmed my stake and locked in a considerable amount of long term gains. I intend to remain invested in Tesla for the long run, unless the investment case changes substantially in some unexpected way. It is still the best stock I've ever owned so far in terms of returns.

Tesla's robotaxi event on October 10th will hopefully tell us more about what our vehicles will or will not do in the future. We'll see.