Tesla is an Autonomous Vehicles Bet Now

When I began investing in Tesla (TSLA) in 2019, I bought the stock because I believed in electric vehicles. They made sense to me. Someday, we'll be out of gas. We'll need electric vehicles. Stocks go up in the long run and demand for electric vehicles will grow in the future, so I made it a long term investment. I've been lucky enough to lock in multi-bagger profits along the way. Today, I am still heavily invested in the company. It's still my largest holding, at 17% of my investing portfolio.

Tesla cornered the EV market in the early 2020s, growing its sales impressively. My stock soared. Tesla was overbought in 2021, before the EV wave fizzled out with interest rates jacked up. The stock's value was cut in half midway through 2024, 3 years after topping out during the pandemic money printing run. These days, electric vehicle sales are decelerating. Other automakers struggle to sell them profitably. Despite the Cybertruck being the best selling $100K+ truck, Teslas are less exceptional nowadays than they used to be. People who want to buy electric have other options besides the Model 3. But they still have a competitive advantage over legacy auto. China is a different story. Most likely, the government will tax the Chinese vehicles to help out American EV makers.

In 2024, the company finds itself heading down a new road: autonomous vehicles. Elon himself said on the earnings calls, if you don't believe vehicles will drive themselves someday, sell the stock. The rise of the robotaxi is now what we investors are told to wait for.

A bet on Tesla is a bet on electric vehicles, robotaxis and some additional moonshots. In order for the stock price to hold up, they need the Cybercab to be unveiled and they'll need to grow other revenue streams.

Tesla changed the world by being the first profitable pure electric vehicle maker. The trillion dollar question is now... can they change the world again?

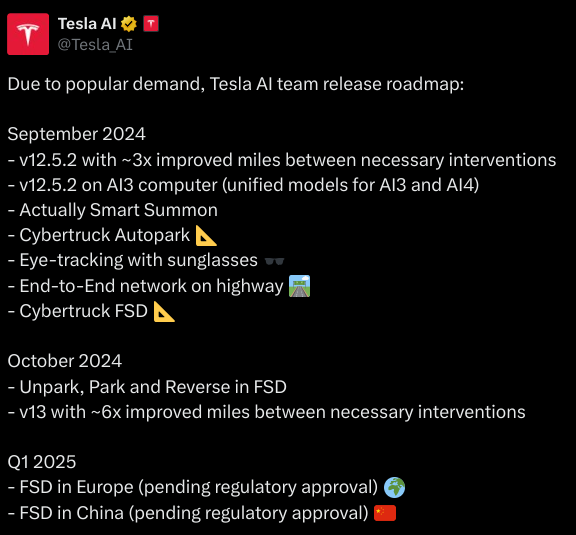

They have a convincing product with Full Self Driving (FSD) seemingly improving every month. But what are the real timelines we'll see for autonomous vehicles? Teslas may also face opposition from other motorists on the road. If no one is driving the car, will other drivers accept Teslas driving on the road and not interfere with them? Will lawmakers allow these cars to run the streets?

Waymo is already active in a small grid of California and Baidu (BIDU) is assisting Tesla with mapping in China. They also announced their Uber partnership is expanding to Austin and Atlanta. Will the world continue to shift to AI vehicles?

Despite the uncertainty of this line of new autonomous business, we should not count Tesla out. It's a company with many irons in the fire that could yield profits in the future. For example, 46% of Q2 net income came from Tesla's energy business, not from EVs. It also claims it's now using its Optimus robot in production.

I'm not sure what the probability is that Tesla succeeds in autonomous vehicles. Because of this uncertainty, I've trimmed my stake and locked in a considerable amount of long term gains. I intend to remain invested in Tesla for the long run, unless the investment case changes substantially in some unexpected way. It is still the best stock I've ever owned so far in terms of returns.

Tesla's robotaxi event on October 10th will hopefully tell us more about what our vehicles will or will not do in the future. We'll see.