The Tension Between Growth and Dividend Stocks

Lately there has been a discourse online about the problems with dividend stocks. In the past, dividend stocks have held more favor with investors. I find it interesting that recently they've been cast as questionable investment for the long term investor. So what's wrong with getting a cash dividend back from your investments? The market seemed to be selling off these assets in the summer months of 2023. I think this is proof that all the critics come out of the woodwork when a stock's price is trending down.

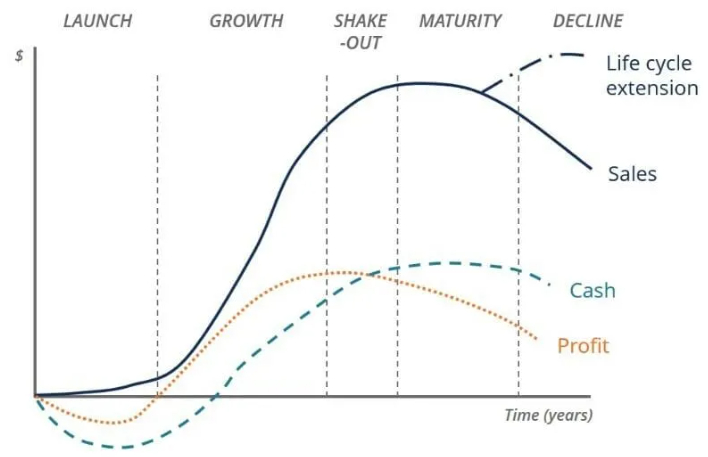

The thinking is that when a company returns money to its owners, it's a last resort. The company is saying, "We have nothing better to do with this cash pile, so let's give it back it to our shareholders." It's a win-win situation, right? Kind of. Growth stock zealots are quick to point out that the money returned to the company's owners will deflate the stock price in the long run. I guess this is true. Instead of a dividend, a company can also choose to "buy back" its own stock instead, raising the price for shareholders without incurring any taxes. They could also invest in their business to increase future profits. Dividends are seen as characteristic of a business that is in its "declining corporation" phase, rather than its "wait until you see what we're going to do in the future" phase.

At the moment, 22% of my savings is allocated into dividend-paying ETFs, mutual funds or stocks. According to Google Finance, my taxable portfolio and self-contributed IRA contain 8% medium dividend investments and 31% high P/E (price to earnings) investments. A stock's higher price to earnings ratio indicates it is trading at a multiple of its current earnings and is more likely associated with traditional growth stocks. You have to pay a higher multiple to gain the income streams of these high P/E businesses. I want to invest more into dividend stocks to raise my passive income level. Currently I earn around $50/month from my investments. Most of this is automatically reinvested.

You get to choose if you want to reinvest your dividends or take them as cash in your pocket. If you take it in cash, you'll need to pay a tax. If you use it to buy more shares automatically, you'll still need to pay a tax. So either way, part of your dividends are going to the government. If you hold foreign assets that pay dividends, the tax gets taken out of your payment before you receive it.

Not all dividends are the same. Yahoo Finance is great for researching dividend yields. It lists the forward dividend & yield of every stock if it pays a dividend. For example, Ford (4.98% yield) and Coca-Cola (3.40%) each yield a larger dividend so I've been scooping up shares. I believe these businesses are rock solid. Thanks to the dividend stock summer sale, they have pulled back from their all-time highs. I'm betting they will still be thriving 30 years from now. Hopefully, their yield will boost my passive income along the way if needed. I like having the option to turn off drip investing and flip them to cash if I need some extra money. Their prices also tend to be more stable. Whereas a growth stock needs to continue its trajectory of growth in order to justify its price to earnings multiples. If the economy slows down, they might suffer.

A 3-6% dividend yield is seen as a "goldlocks zone" of dividends. Anything higher than that might be a "value trap", luring in yield chasers to a owning a business with questionable fundamentals. If you are paid a whopping dividend but the price of your shares is decreasing, it offsets your returns. It may not be the best move to invest, despite reaping these giant yields.

Age is a factor to consider how much you want to commit to dividend versus growth stocks. I'm 33 years old, so I likely have an easy 20-30 years before I'd want to use my invested money, barring emergencies or large purchases where I need to raise cash. If you're younger, the growth stock enthusiasts say you should be more oriented for long term growth.

There's also the concept of a hybrid "dividend growth" stock. Microsoft (0.90%), Apple (0.54%) and Nvidia (0.04%) are examples of companies with higher P/E ratios that are rapidly growing their business and pay a smaller dividend than Coke or Ford. These types of companies are a happy medium between dividend and growth in my opinion.

In conclusion, I propose that a mix of dividend and growth stocks is the best approach to investing. Like most things in life, it's not all-or-nothing. Your allocation depends on your financial goals, risk tolerance, salary and age. If your salary is comfortable, you may not need to worry about passive income and can re-invest your cash payouts. If you're unemployed, you can use dividends to spell your expenses. Later in life, you might be lucky enough to live off your dividends. I hope to get there someday!