Jan 22, 2025

In investing, we get it wrong sometimes. It's called being human. Investing in single stocks is a constant reassessment. Just because you made a mistake in the past, doesn't mean you have to live with it forever.

In the past, I treated my Netflix (NFLX) position like a trade. I took some profits above $500 in 2021. Life was good. Foolishly, I began to doubt the security of the business when the stock suffered a 60% drawdown in 2022.

I always thought I had strong conviction to hold through bad times, but I'd never seen a stock move like Netflix did in 2022. And it wasn't just Netflix that suffered that year. Most of the stocks in my portfolio went through corrections or more extreme drawdowns. I started to look at each of my stocks and think, which of these can I really trust? I was a bit scared of seeing more stocks sell off. It definitely affected me psychologically to see my frothy gains of 2021 slowly disappear by the end of 2022. In hindsight, this was the time to buy. I did buy a lot back then, but also made some mistakes. One of the biggest being Netflix.

While I saw my portfolio under siege that year, I began to doubt how safe of an investment Netflix was. I lost sight of the big picture. Then I was thinking about how my position of 5 remaining shares was more than cut in half in a year. I started viewing my shares as a trade in terms of dollars rather than a company I own for the long term. This was my undoing. I believe this tension exists in the stock market for all of us. Am I a trader or an investor? That is decided by every move you make, buying or selling over time. In this case I was an investor who became a trader due to the extreme circumstances of losing money. It's an internal battle we all must be aware of when we buy stocks.

Subscribers growth was falling, basically only for one quarter. (Another rookie mistake, putting too much emphasis on one quarter). Now the company says they won't even report quarterly subscriber numbers. Wavering subscriber number worries were the main reason I felt uncertainty. Now the company is shifting to focus on profitability.

By 2023, 3 years after getting in, I had lost my conviction. I sold out my last Netflix share at $375 because I needed extra money and took a little last sliver of profit.

I no longer believed in the fundamentals because the stock price took a dive. For the first time in years, the growth was in question. Then, of course, it recovered. The stock went up 2-3x after I sold. It's been a hard lesson to learn. The silver lining is that the experience I gained might help me invest better in the future. Sometimes we lose sight of the big picture. Sometimes we flip from bull to bear. It happens.

When I was in business school, we'd read case studies about Netflix and how they changed the media game. They started as a mail-in DVD company and adapted into streaming. It's a great story. I have a hypothesis that the companies that make the right moves that get written about in biz school case studies are the companies you want to own, as long as they're still dominating their market.

Recently, the price skyrocketed over $100 in single trading day. Their recent Q4 earnings report showed strength. An impressive subscriber growth beat, price increases and growing live sports are positive catalysts. The big picture looks great for this company and they are growing on many facets. The difference is I was holding the stock again. It felt great to see the earnings report send shares soaring.

A month before the Q4 2024 slam dunk earnings report, I bought back in for 3 shares at $911. I decided I couldn't be on the wrong side of history anymore. I don't know what's going to happen next, but I know I want to own Netflix. This company is making the right moves. My gains aren't as big as if I had held onto my original lot, but it feels good to have some Netflix gains again. I see the big picture. This time if the stock drops big, I'll be buying more.

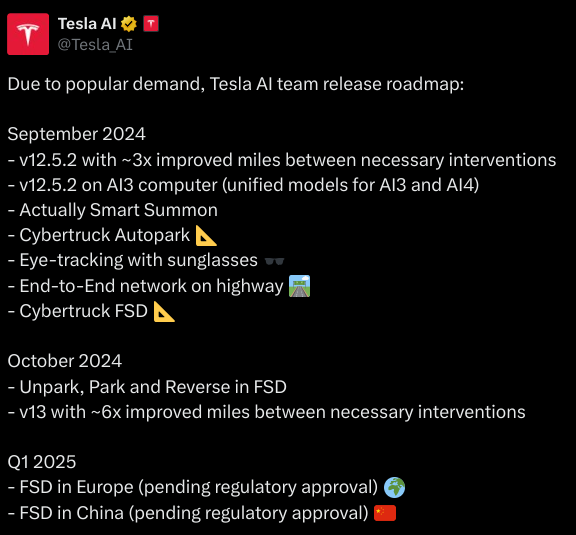

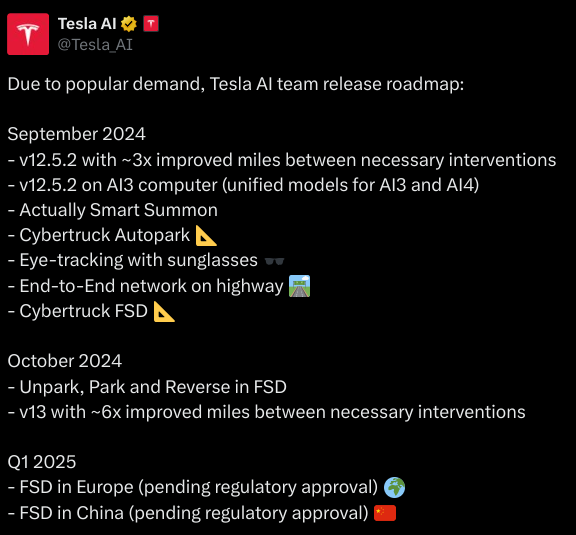

Sep 05, 2024

When I began investing in Tesla (TSLA) in 2019, I bought the stock because I believed in electric vehicles. They made sense to me. Someday, we'll be out of gas. We'll need electric vehicles. Stocks go up in the long run and demand for electric vehicles will grow in the future, so I made it a long term investment. I've been lucky enough to lock in multi-bagger profits along the way. Today, I am still heavily invested in the company. It's still my largest holding, at 17% of my investing portfolio.

Tesla cornered the EV market in the early 2020s, growing its sales impressively. My stock soared. Tesla was overbought in 2021, before the EV wave fizzled out with interest rates jacked up. The stock's value was cut in half midway through 2024, 3 years after topping out during the pandemic money printing run. These days, electric vehicle sales are decelerating. Other automakers struggle to sell them profitably. Despite the Cybertruck being the best selling $100K+ truck, Teslas are less exceptional nowadays than they used to be. People who want to buy electric have other options besides the Model 3. But they still have a competitive advantage over legacy auto. China is a different story. Most likely, the government will tax the Chinese vehicles to help out American EV makers.

In 2024, the company finds itself heading down a new road: autonomous vehicles. Elon himself said on the earnings calls, if you don't believe vehicles will drive themselves someday, sell the stock. The rise of the robotaxi is now what we investors are told to wait for.

A bet on Tesla is a bet on electric vehicles, robotaxis and some additional moonshots. In order for the stock price to hold up, they need the Cybercab to be unveiled and they'll need to grow other revenue streams.

Tesla changed the world by being the first profitable pure electric vehicle maker. The trillion dollar question is now... can they change the world again?

They have a convincing product with Full Self Driving (FSD) seemingly improving every month. But what are the real timelines we'll see for autonomous vehicles? Teslas may also face opposition from other motorists on the road. If no one is driving the car, will other drivers accept Teslas driving on the road and not interfere with them? Will lawmakers allow these cars to run the streets?

Waymo is already active in a small grid of California and Baidu (BIDU) is assisting Tesla with mapping in China. They also announced their Uber partnership is expanding to Austin and Atlanta. Will the world continue to shift to AI vehicles?

Despite the uncertainty of this line of new autonomous business, we should not count Tesla out. It's a company with many irons in the fire that could yield profits in the future. For example, 46% of Q2 net income came from Tesla's energy business, not from EVs. It also claims it's now using its Optimus robot in production.

I'm not sure what the probability is that Tesla succeeds in autonomous vehicles. Because of this uncertainty, I've trimmed my stake and locked in a considerable amount of long term gains. I intend to remain invested in Tesla for the long run, unless the investment case changes substantially in some unexpected way. It is still the best stock I've ever owned so far in terms of returns.

Tesla's robotaxi event on October 10th will hopefully tell us more about what our vehicles will or will not do in the future. We'll see.

Aug 22, 2024

I am a "Buy and hold" investor, but not forever. More like buy, hold and make sure the business delivers value or sell. The question often comes up, "When do I sell?". This is unique to every investment and each investor's goals. For me, the baseline of the S&P 500 is a consideration. Do I think this stock can beat the returns of the S&P 500? If the answer is no, I probably will sell the stock.

I've needed to raise money from my stock portfolio this year. More often, I chose to sell some underperforming stocks at a loss or small profit versus trimming the winners. Each of these stocks was held for at least 1-3 years until I decided to close the position. Here are stocks I sold out of recently and why:

Snowflake (SNOW)

- sold for: -$1,155.92 loss (-17.56%)

- reason: excessive stock based compensation (41% of revenue), usage based model still needs to be proved, management sub-par + killed the stock price, not currently profitable, product is a glorified database?

Etsy (ETSY)

- sold for: -$1,594.53 loss (-37.55%)

- reason: earnings reports have been consistently underwhelming, competition from Shein/Temu, lack of relevance and growth slowing

The Charles Schwab Corporation (SCHW)

- sold for: +$176.36 gain (+14.65%)

- reason: lackluster earning reports, sentiment very low, new brokerage/Robinhood competition, customer outages, lack of growth prospects, lack of understanding how banks make money (unfamiliar with banking industry)

DigitalOcean (DOCN)

- sold for: -$324.36 loss (-31.56%)

- reason: not profitable, competitor with AWS, rotated to Amazon (AMZN)

Canopy Growth Corporation (CGC)

- sold for: -$1,052.01 loss (-87.07%)

- reason: not profitable + constant public offerings of stock to fund business operations

Coursera (COUR)

- sold for: -$741.27 loss (-52.89%)

- reason: not profitable, product potential existential threat by AI, prefer better opportunities to invest

Datadog (DDOG)

- sold for: $469.79 gain (+21.21%)

- reason: cutting back tech exposure, huge customer bills often reported negatively

UIPath (PATH)

- sold for: -$312.96 loss (-51.44%)

- reason: recent CEO shakeup, product potential existential threat by AI, not profitable

Roku (ROKU)

- sold for: -$631.42 loss (-36.62%)

- reason: dependent on TV manufacturers, TV Operating System needs distribution, not profitable, lack of a moat?

Yeti (YETI)

- sold for: -$567.01 loss (-31.11%)

- reason: prefer other industries than outdoor coolers and drinkware

Okta (OKTA)

- sold for: -$86.19 loss (-3.15%)

- reason: decided to consolidate tech holdings, rotated position into Crowdstrike (CRWD)

Grab (GRAB)

- sold for: +$36.80 gain (+7.32%)

- reason: not profitable, don't like the industry economics (rideshare and delivery)

Dutch Bros (BROS)

- sold for: +$6.14 gain (+2.11%)

- reason: recent food and beverage industry headwinds, will take years to build out new locations

Portillos (PTLO)

- sold for: -$440.36 loss (-55.47%)

- reason: recent food and beverage industry headwinds, will take years to build out new locations

Sunrun (RUN)

- sold for: -$1,242.67 (-54.58%)

- reason: consolidating solar industry positions and prefer Enphase Energy or First Solar

Sofi Technologies (SOFI)

- sold for: -$362.07 (-34.55%)

- reason: price trades erratically, prefer to invest in other industries, lack of understanding how banks make money (unfamiliar with banking industry)

Conclusion

Time will tell where these companies go. Each investment you choose has an opportunity cost. If you invest in one stock, you can't invest in another. I sold these stocks because I needed the money, but also because I felt that I should consolidate my portfolio into fewer positions. I hope by selling off the worst performers, I will hold onto the stocks that give great returns in the future.

Aug 15, 2024

In July and August, I listened to 25 earnings calls and read 2 call transcripts for the quarter.

This is the best I've ever done in terms of covering the earnings reports for companies I own. At the moment

I'm holding 38 stocks with 6 more companies yet to report for this quarter. Below, I have written some themes and

patterns observed here to reflect on what I heard in the past month.

Rate Cuts Are Coming

I heard many variations of "rate cuts coming later this year" meaning good times are coming for a lot of companies.

Nerdwallet (NRDS) said their loans business will pick up once rate cuts happen. Solar companies like

Enphase Energy (ENPH) said "lower rates will be a tailwind" on their earnings call.

The consensus says the first rate cut will be in September.

Currency Volatility Uncertainty

On the Coca-Cola (KO) earnings call, they mentioned the possiblity of 10% "currency headwinds". I heard similar rhetoric cited as a headwind on many of the calls. Apple (AAPL) guided to expect a "foreign exchange headwinds impact on YoY basis"

The State of the Consumer

As always, there is an interest in understanding the state of the consumer within the lens of the broader economy.

How good or bad are they doing? Coca-Cola (KO) noted they are seeing a "resilient consumer".

Chipotle (CMG) said on their earnings call they are seeing a "pullback in spending" by the consumer.

In general, the narrative seems to be "the consumer is struggling", but the best companies seem to be

unaffected or even thriving regardless.

Streamers Are Turning Profitable

Disney (DIS) and Paramount (PARA) both reached streaming profitability on their respective platforms,

Disney+ and Paramount+ in this quarter. Disney's three headed monster of Hulu, Disney+ and ESPN is now making money.

It seems legacy media is figuring out how to run a streaming platform that makes money. Spotify (SPOT) also recorded

its 3rd consecutive quarter of profitability in the audio streaming world. Fubo (FUBO) is the other streamer

I follow which is not currently profitable but is giving promising guidance for the future by raising revenue and subscriber guidance. FUBO won an injunction in court against VENU, the new sports streaming joint venture from Disney and Warner Bros. They're guiding to be profitable sometime in 2025.

Food & Beverage Fading

On the Pinterest (PINS) call, they noted "broader headwinds" for their food & beverage customers. In general, restaurant brands and beverage companies are seeing a slowdown in business. Who knows how long this will last.

China Growth is at a Premium

After a period of relative prosperity for American companies operating in China, it seems the growth has stalled

or at least slowed down. This quarter, Apple's China sales were down 6% (3% currency related). They did celebrate

a record high Chinese install base for the quarter. Crocs (CROX) is showing impressive growth with 70% sales growth

in China. Tesla (TSLA) China growth has declined with the overall auto industry lull in recent years. It has good

relationships in China for its robotaxi operations to flourish, but when? Lately, the Chinese seem to be opting in

favor of products from Chinese companies. Companies with superior products will win in China but not everyone will

be able to compete with Chinese counterparts.

Buybacks are Boomin'

Lots of companies I own are aggressively buying back their own stock through share repurchases. It seems to be buybacks season for some reason. Here are a few that I noted: Paypal (PYPL), Alibaba (BABA), Apple (AAPL), Block (SQ), Crocs (CROX) and Enphase Energy (ENPH).

Tough Times in the Auto Industry

Almost all automakers have experienced a rough 2024. The ones that are doing well have capitalized by selling hybrid vehicles.

The earnings reactions for almost all of them that I follow were negative after they reported:

- Ford, F -12%

- Toyota, TM - 6%

- Tesla, TSLA -12%

- Rivian, RIVN - 5%

As Elon once tweeted, it's hard to turn profits in the auto business. This is another sector that seemingly should benefit with rate cuts because it makes the loan to buy a car cheaper.

Marijuana Stocks Will Benefit from Relaxed Government Regulation in the Future

This is nothing new as murmurs of descheduling marijuana have floated around for years and state legislation change is ongoing. But this time it might be different. On their earnings call, Cresco Labs (CRLBF) said polls show support for schedule III drug reclassification. They are watching as adult use legislation hits the ballot in Florida in November, a crucial state with lots of potential. No one knows when the federal reclassification will hit the US. Cresco said on its recent earnings call, "Reform is imminent and we are ready."

Disclosure: the author holds the stocks mentioned at the time of writing.

Jul 23, 2024

It is tough to judge a product's value and its effect on the company's stock price. You might, in your own bubble, conclude a stock will change the world. Based off your own experience loving the product, you buy the stock. Sometimes this approach can work, but it is no silver bullet. In this post, I'll consider 2 examples of unique value adding products that did actually translate into rising share price, Spotify (SPOT) and Crocs (CROX).

I've learned many times how easy it is to overpay for a stock. If you blindly buy a stock because you are a customer, you can get burned buying at excessive valuation multiples or buying right before the business hits a down cycle.

The best companies warrant buying at high multiples, but it's an elite group. As we saw with the recent Crowdstrike fiasco, a company's reach is a double-edged sword that can be self-inflictive. Risk is always present in stocks. With that said, let's move on to cases where this did work out... so far.

SPOT

Since 2012, I used Spotify happily. In 2020, applying this product --> stock logic, I bought my first SPOT shares at $158. I voluntarily pay each month to have a full library of songs on my phone. Why not own this company? I got in and watched it soar in 2020 and 2021.

In 2021 the stock price ballooned and I bought 2 more shares at $320. Then 2022 arrived and SPOT fell under $100. Seeing a DCA opportunity in fall 2022, I scooped more shares around $75-$100, doubling down on my position.

Since then, Spotify has shown they are the real deal. Monthly active users continue to grow. Revenue was up 20% in Q1 2024. A savvy shift into podcasts has made the product even more compelling. Shares are back over $300. The company reached profitability in Q3 2023 for the 1st time in a year. Spotify is flexing its pricing power by raising subscription prices.

SPOT Surges After Reporting Earnings, Google

Wall Street is starting to notice what Spotify is building. After today's earnings report the stock jumped 12%. They're striking the right chords with Wall Street and delivering consistent growth. They look more and more like a strong business who will be flowing cash for a long time.

CROX

CROX shoes stand out. They're comfortable, versatile and as funky as you want them to be. They're taking the world by storm. But how profitable could a shoemaker be? One thing that sets CROX apart is that most of its shoes are variations from the same core design. That seemingly boosts their profit margins.

Although I've never tried Crocs myself, I see them everywhere I go. They are a phenomenon that many people don't want to acknowledge. Most of my life, they were an afterthought. I often remarked in the past how polarizing they were amongst the people I knew. Either you wore Crocs or you saw them as hideous, with very few in between. It turns out there are enough of the former to keep Crocs growing profitably for the past 10 years.

Crocs Shoes, Crocs Website

After seeing the stock dip under $90 in fall 2023, I decided to roll the dice on it. I bought more from $100-$140. It's up 40% year to date. Now, it's my 7th largest stock position. Some might prefer to invest elsewhere than shoes. Q1 2024 net income was $792.6 million compared to $540.2 million in 2022. 32 million pairs of Crocs were sold in Q1 2024, up 3% YoY. I believe this is an extraordinary shoe product with compounding and growth potential.

One pleasant surprise has been their management. They are locked in and performing well after following the company the past year. They sold 119.6 million pairs of shoes worldwide for the Crocs Brand. This is a great product that seems to have half the Earth hooked, and the other half disgusted. Crocs acquiring HEYDUDE left an overhang that should lift with the strength of another established brand finding its footing.

Product success does not equal stock success. However, it gives me more conviction to see the product frequently when out in the world. If you are experiencing the value of the product first hand, it's valuable to see how it performs its function in the real world. This product guided perspective of stock picking has worked sometimes in my experience. However, beware of your own echo chamber. It's easy to overestimate the value delivered and its future value.

disclosure: not financial advice. The author holds positions in SPOT and CROX.

Jul 15, 2024

When you find gainful employment, any employer worth a damn will offer benefits like a retirement 401(k), IRA plan or Health Savings Account (HSA). This is a reflection of how I made some smart moves with 2 previously dormant savings funds.

My HSA and IRA providers both listed all of the 20 or so funds to choose from with their plan fee rates. Every plan administrator will make a variety of funds accessible to you. There's usually options like a growth fund, total market fund, bonds fund, an international fund or small caps fund with more expensive fees. The cheapest option is usually a fund that tracks the S&P 500. In my case, my HSA S&P fund fee is 0.04% and the IRA S&P fund fee is 0.03%. Buying the S&P 500 was the cheapest in my case.

If you want to diversify your market exposure and gain better returns, it is tempting to try some of the other market or growth funds. However, the S&P 500 is more or less a lock to be a good investment. I'm buying as much of it as I can. In retrospect, I should have allocated more to the S&P index and less to individual stocks. Hindsight is 20/20. This month, I've essentially tripled down on the S&P 500. With my two retirement accounts now allocated to S&P 500 funds, I successfully bumped up my investment portfolio allocation from 2% to 7% in S&P 500 funds. Now I feel sufficiently exposed to the index. Who knows what that will grow to in the future.

S&P 500 Price From 2019-2024, Google

I contributed to an HSA in my most recent job. My HSA provider was bought out, requiring a transfer to a new provider. After waiting for 6 months, I could finally invest my HSA funds after they were locked up in the transition from the old provider. I scanned the options to deploy this block of savings, noticing a fund named "Vanguard 500 Admiral Shares". This is a Vanguard S&P 500 fund, ticker VFIAX. I set the allocation to 100% and can now forget it for the next 20 years. One quirk of my HSA is that I'm required to keep $1000 in cash for medical expenses, so technically it's not all in the market. I have a card I can use to pay for medical needs that draws from the cash in the account. It's nice to have this extra cash savings set aside for medical expenses!

With my HSA settled into place, I turned my attention to a pesky IRA that eluded my understanding for far too long. I recently recovered the IRA from past employment I held 10+ years ago from my first job after college. I was not properly onboarded to the account from the onset and never really knew what was going on. To my surprise, I discovered it had been transferred from the previous bank that held the retirement fund to a new plan provider without any notice to me.

After calling the new provider, I finally gained online access to the IRA savings earlier this year. My savings had been auto-rolled to the new retirement plan provider and invested into a money market fund. Since being transferred, the IRA's account balance was slightly negative over 1.5 years in the money market fund after the provider fees being extracted from the account! The S&P 500 is up 36% over the same time period since Jan. 2023. I swiftly rebalanced the account to 100% allocation in Blackrock's WFSPX iShares S&P 500 index fund, the only S&P 500 fund the new retirement plan provider offered.

"The best time to plant a tree was 20 years ago. The second best time is now." - Unknown

This past year and a half was a missed opportunity for my IRA in hindsight. Not to mention the 8 years prior. It is a hard lesson to learn. I could have doubled that savings account had I invested it in the S&P 500 back in 2016. However, the important thing once you've realized a mistake is to correct course immediately and get the money invested. I want to let it grow with time by taking some risk in stocks. The S&P has proven itself consistently to steadily appreciate in the long run, despite a drawdown happening 1 in every 5 or so years. In 2024, it is up 18% year to date at the halfway point. It could and probably will retrace at some point. If you're a long term investor, the S&P is a stable bet, but not without some risk.

If possible, you may want to roll your IRA into your own custody. It's not possible currently with my HSA. I plan to do this for the IRA but in the short to medium term, it's now deployed into the S&P 500. Common sense investing for the win.

If you're not sure how your retirement money is being deployed, call the plan provider and gain control of your online account. Find out where your money is being put to work. When you've held multiple jobs, it's easy to let a retirement account fall to the wayside. I missed out on some easy market gains over the past year and a half because of this. Learn from my mistakes. Keep a good watch of your employment retirement savings and make sure they are working for you.

May 25, 2024

Don't put all your eggs in one basket. We can avoid this scenario by taking positions that act as a hedge against one another.

Here are some examples of hedge pair trades that I've taken in my portfolio:

1) Nvidia vs. Emerging Semiconductors

Right now the most common argument against buying Nvidia stock is that they may not be able to maintain their 95% market share only forever.

I'm holding an Nvidia long position but realized when I buy other semiconductors it's a hedge against their dominant position eroding over time.

Here are the top 10 holdings of the SOXX Semiconductor ETF:

NVDA NVIDIA Corporation (9.74%)

AVGO Broadcom Inc. (7.95%)

QCOM QUALCOMM Incorporated (7.41%)

AMD Advanced Micro Devices, Inc. (6.18%)

MU Micron Technology, Inc. (5.18%)

ADI Analog Devices, Inc. (4.54%)

TXN Texas Instruments Incorporated (4.38%)

MCHP Microchip Technology Incorporated (4.33%)

TSM Taiwan Semiconductor Manufacturing (4.17%)

KLAC Kla Corp (4.16%)

source: https://www.ishares.com/us/products/239705/ishares-phlx-semiconductor-etf

Other notable holdings include Intel, Marvell, Lam Research and a basket of 30+ semiconductor related companies. If you're bullish on semiconductors, why not play the field? You're still buying Nvidia, but spreading your bet amongst a bunch of promising companies. If you believe a rising tide lifts all boats and there will be many winners in our AI future... why not own some Nvidia and something like the SOXX ETF?

2) Tesla + EVs + China Automakers (Future Automobiles) Vs. Toyota + Ford (Legacy Automobiles)

Tesla boomed in the early 2020s by riding the EV wave and a low interest rate environment to payday. However, now the reality of 2024 is setting in for the electric vehicle market. Our EV future is somewhat postponed at the moment, or maybe it will take longer than we thought.

Where we are in the EV timeline depends on where you live. Countries like Ethiopia are preventing the import of internal combustion engines!

In China, the EV future is progressing faster than anywhere else in the world. China automakers are showing a new wave of affordable,

tech forward electric vehicles are possible. Tesla is not the only one who can win at electric vehicles anymore. The rest of the world's automakers know a sleeping giant looms with Chinese automakers. Companies like BYD, Xpeng, Li Auto and Nio will play a significant role in the world's automotive landscape of the future.

Hybrid vehicles have emerged as the most sought after type of vehicle after Tesla rode the EV boom into 2021. Toyota is notably the biggest winner in the resurgence of hybrids and the purest play to fade our electric vehicle future. Toyota has been vocal in their opposition against the feasibility of electric vehicles. Ford is also losing money on its electric vehicle program but has remained committed to a profitable electric vehicle in the future, so they are less of a direct play against Tesla.

Holding both Tesla and legacy auto is a way to play both sides of the transition to electric vehicles. If consumer tastes move towards hybrids in the short term, Tesla will have a tougher environment to sell cars and Toyota will reap rewards from selling more hybrids. If electric vehicles gain traction quicker than expected, fade legacy auto if they fail to adapt to what kind of car people want to buy in the future. According to Llama 3 AI, we have an estimated 50-60 years of gasoline fossil fuels left on the planet. Someday, we'll need EVs and it won't be a choice. Who knows when that will actually happen. Play both sides of the trade by holding Tesla or Chinese electric vehicle makers against legacy automakers.

3) Bitcoin vs. Ethereum + Alt-Coins

Bitcoin was the first mover in the crypto world. Ethereum has solidified as #2 in the crypto space. Most likely both will be important in cryptocurrency's future, but you could see better returns in some alt-coins in the short term. Crypto has a feel like there will be "many winners" in the long run, but who knows how many and for which use cases. Or maybe it will be like big tech, with only an oligarchy of coins reaching elite status. It's too early to tell how this space will shake out in the long run, so I'm holding some smaller cap coins along with a heavy weighting of the blue-chip coins.

Wrapping Up

It's important to identify when an industry has "many winners" versus possibly only a few elite companies that emerge in the long run. It's possible to have the right industry, but not the right execution by the company you own. We can mitigate risk by making trades that hedge each other. This might limit gains on a higher conviction play, but it also caps your losses if the play doesn't pan out.

Apr 20, 2024

I am an advocate for long term buy and hold investing. However, this post will play devil's advocate from my normal stance. Most times, we should wait for our investments to recover their value before selling. Here are some reasons that can justify selling out for less than you invested.

You Feel Like You Overpaid

The market tends to swing from bull to bear in a span of weeks or days. Sometimes the market collectively peaks and then drops off big. If you buy the top of a stock and then it deflates, there's no guarantee you'll ever recover your losses. For example in 2020, I bought 5 shares of PayPal at $196. Currently the price sits at $62 and I'm down 68% on those first 5 shares. The difference in the price I entered the position and the current price is a wide margin. I have dollar cost averaged down, now holding 25 shares and will break even at $91. But the buy on the 1st 5 shares will likely be under water for a long time. In this case, I sold two of the original 5 shares at a loss last year. By doing this, I'm mitigating risk and converting a bad buy into tax loss credits. Now, if I was more bullish I'd hold. PayPal has underwhelmed in recent years and the stock has a lot of bad juju. Not to mention, the payments space is very crowded with Apple Pay and Google Pay possibly set to poach PayPal's business. So I wouldn't recommend it to anyone. However, after its 3 year slump, maybe it will make a comeback. I felt like I overpaid when I opened the position, so this is an example where I divested some by taking a loss on some of the shares I bought for 3x the current market price.

Taking Losses Off the Books

When you buy a stock and it goes underwater, those buys will weigh down your portfolio's returns. By selling at a loss, you're taking that loss off your books and using it to lower your taxable income. Divesting limits your exposure if it never recovers.

"Cutting the Fat"

This is a common phrase you hear when people talk about investing and managing their portfolio. The "fat" is your bad positions. By removing it, you leave the leaner, quality "meat", aka the stocks that actually perform well. In a sense, this is a good habit to apply to your portfolio in order to rebalance and mitigate risk.

Selling Businesses That Fail to Execute

Everyone talks about fundamentals in investing. When investors talk about fundamentals, it basically means, is the business executing? Are they making money and executing their strategy? Yeti is an example of a business with a strong brand in drinkware and outdoor coolers that has lacked in execution recently. In 2023, they had to recall a soft cooler product, one of their top selling lines of business. The company has not sparked much excitement, despite their new partnership to sell in Tractor Supply Company stores. They could turn it around, but after opening the position in 2021 and adding over the past few years I chose to divest part of the position at breakeven. So I didn't take a loss in this case, but after reading their earnings call transcripts and reports in 2023, I decided that there are better opportunities than this company. I haven't sold out completely but I would consider selling at a loss if Yeti's woes continue.

Selling Your Weakest Holdings Instead of Your Winners

If you need to sell, let your winners run. If life requires that you sell stocks for money, selling your worst performing stocks is more justifiable than selling your best performers in some cases.

Reducing the Size of a Bet

Taking a little money off the table is a way to manage your risk and exposure to the turbulence of stocks. This is more applicable to taking profits in my opinion. Selling at a loss is another way to achieve reducing the amount of your free cash you have invested in any single stock. If it's not working, I'm more likely to take a small chunk of the position elsewhere, either at breakeven or taking a loss.

Better Opportunities

Even if you are in the red on a stock, it might be a better move to sell out half or all of the position. Then you can take that cash and rotate it into a stock that has better fundamentals and momentum. This is somewhat risky but is a way that you can shift an underperforming stock into a stock that has a better chance of making actual returns on equity.

Conclusion

Buy and hold for a long time should be the default setting for most investors. Most times, we should do nothing. Nonetheless, it's not always the right move. On rare occasions, we should cut our losses and run to a better stock.

Disclosure: not financial advice. The author holds the stocks mentioned.

Apr 03, 2024

Something I've been meditating on lately is the concept of "letting my winners run". This is a common trope in investing. In a nutshell, the idea is hang on to your best stocks and sell the bad ones if you need to sell something. Of course, it's not so cut and dried. How do you know which ones are the good stocks?

Additionally, at what point do you harvest gains on an investment? The hang-up is that you could sell a stock too early. This is a solid reason for long term investing, holding a stock for many years, regardless of what the price of the asset is. In theory, this should be easy. Just hold onto your shares. In practice, it's much more difficult to let your winners keep winning. Why?

Sometimes we need money to live or pay for things. A lot of times, stocks are a source of money that provides a means to an end. I can't fault anyone who sells for this reason, I've done it many times.

Diversification is another valid reason to take profits. When a stock increases in value more rapidly than the rest of your portfolio, it begins to have an outsized impact on its trajectory. However, be cautious of selling too early in the name of reducing risk.

Conviction to hold a stock comes from the prospects of the business it represents to make money. The stability of a business can fluctuate wildly in a chaotic world. If for some reason you lost your conviction to hold a company, I understand that as well. Investing is not "forever", it's only as long as you believe the company has positive cash flow and will continue to reap profits.

Many times a stock can shoot up in a short period of time, and then it's flat or negative for years at a time. It's impossible to know when a stock is about to run. In those years of consolidation, it's easy to look at the hot stock of the moment that's blowing up. It's easy to start thinking, "Why am I holding stock A when stock B is about to take off?" So you rotate into stock B just in time for its period of consolidation.

Price can also become disconnected from the fundamentals of a business. It's easy to start second-guessing what could happen to a stock's price if a black swan event were to hit its industry. Nvidia comes to mind as a company whose stock price rocketed up so fast above $400, that many people started screaming sell. Time will tell if it was too early to sell Nvidia. Currently the price hovers around $900/share, and some people are still selling because the price went up. The price of an asset rising is not always a good reason to sell.

Additionally, humans are wired to appreciate making money but to fear with more intensity losing what we've gained. This can cloud our vision. When we start thinking about preserving our unrealized gains, we're no longer investing in a sense. In that moment, we are more like a trader speculating on short-term price movements. This is why, in my opinion, it's so hard to let your winners run. We want to preserve our wins.

We need to shed our instinctual preservation tendencies in order to really win big in the stock market. Most of the time, you need play the game for 10, 20 or 30 years to win at stocks. Hold for a long time and ignore your fears of losing your wins.

As is often said of stocks, "no one ever went broke taking a profit." My response is: no one ever made it big selling early.

Disclosure: as with all writings on this blog, it is not financial advice. Without risk, we cannot reap rewards. Good luck and happy investing.

Feb 19, 2024

I recently discovered two great functions for tracking stocks and crypto. The GOOGLEFINANCE() function can be used to import stocks and crypto prices. Additionally, the IMPORTDATA() function is able to import cryptocurrency prices from cryptoprices.cc.

Here is the syntax that the Google Finance function expects:

=GOOGLEFINANCE("{Exchange_Ticker}:{Stock_Ticker}")

Note that you can pass other attributes and dates to specify a time frame if required. Refer to the Google documentation links above for more advanced usage.

Import Microsoft's Nasdaq Exchange Stock Price to Google Sheets

=GOOGLEFINANCE("NASDAQ:MSFT")

Import Snowflake's NYSE Exchange Stock Price to Google Sheets

You'll want to make sure the ticker is the correct exchange the stock trades on:

=GOOGLEFINANCE("NYSE:SNOW")

Import Charles Schwab's S&P 500 Mutual Fund Price to Google Sheets

=GOOGLEFINANCE("MUTF:SWPPX")

Google Finance also has the ability to fetch crypto prices for assets like Bitcoin and Ethereum. However, these prices seemed to update less reliably than stocks. I then found the IMPORTDATA() function, which updates crypto prices more reliably in my experience. The website cryptoprices.cc has made the prices available via their website and this function.

Import Bitcoin's Crypto Price to Google Sheets

=IMPORTDATA("https://cryptoprices.cc/BTC")

Import Ethereum's Crypto Price to Google Sheets

=IMPORTDATA("https://cryptoprices.cc/ETH")

If you're interested in other crypto prices, check out the cryptoprices.cc sitemap for all cryptocurrencies available.

Calculating Market Value, Profit and Return on Equity

Once you have the prices of your assets auto-updating in Google Sheets, you can calculate the market value of your holdings by multiplying the price by the number of units, shares or coins you hold of an asset.

(Price x Quantity = Market Value)

=GOOGLEFINANCE("NASDAQ:MSFT") * {# Shares} = Market Value

Once you have your Market Value of your holding, you can subtract the cost basis to see your total profit or gain/loss:

Market Value - Cost Basis = Profit

Once you calculate the profit, you can calculate the return on equity %:

Profit / Cost Basis = ROE %

I am now tracking all my stocks, crypto and index funds in a single Google sheet with these functions. The prices tend to update at minimum every hour, but usually quicker. I'm impressed that Google has this functionality built-in, it's very useful!