Feb 13, 2024

Predicting the way a stock will move on earnings is a dark art. It can be frustrating because a company turns in a clean report, only to have the stock dump after they report. So what drives a stock to move on earnings?

To borrow a line from the movie "My Cousin Vinny", an earnings report is like a house of cards, built by management to communicate how they are a healthy, functioning business. There are several metrics on which the company must perform well, or the house (stock price) might collapse.

Aggressive Revenue Growth

When a company grows its quarterly revenue up unexpectedly, it gets investors' attention. A recent example is Nvidia, which was beating on all metrics to fuel its post earnings report runs. However, its impressive revenue growth grabbed headlines and stoked the excitement around its earnings. Another common metric to monitor is a stock's "average revenue per user" or ARPU.

Earnings Per Share Beat

Earnings per share is one of the most common metrics that gets scrutinized, hand in hand with revenue. It is a cornerstone of the "house" built by management.

Reinvesting to Grow Future Profits

It's bullish when a company announces investments in itself to set up for future growth. For example, while Toyota is dominating the hybrid vehicle market, they're making plans for the future by building factories to address the electric vehicle market. By diversifying into different segments, they're setting up for more growth in the future. A loosely related metric is CAGR, or compound annual growth rate tracks a company's ability to compound growth. A company that reinvests in itself will likely have a stronger CAGR, which investors love.

Impressive Free Cash Flow

Investors love to talk about a company's free cash flow. This is how much cash a business has after accounting for operating expenses, capital expenditures, and taxes. This is the cash leftover that a business can use for dividends, paying debt or reinvesting in the business.

Declaring a Dividend

When a company declares a dividend unexpectedly or has an ongoing reputation as a "dividend aristocrat" they tend to hold more favor with investors. However, be aware of the trade-off the business is making between dividends and reinvesting the money in the business itself. Ultimately, the purpose of any business is to return value to shareholders and this is one way to explicitly achieve it.

Stock Buybacks

Similarly, stock buybacks are another way to return value to shareholders. A large stock buyback can appease investors because it is capital the company allocates directly to raising the stock price. This is money the company could be using elsewhere but it is common practice to buy back your own stock occasionally to return value to shareholders.

Growing Sales Rapidly

The profits of most companies can be traced back to its ability to sell its products. Sales is another metric that investors keep an eye on to see the health of the business. When sales are exploding, so does the stock price. However, sales are only a piece of the house. Growing sales is less impressive if the COGS (Cost of Goods Sold) is offsetting those gains.

Profit Margin

Tesla is an example of a company that has emphasis on its margin on each car it sells. The higher margin they can achieve on each vehicle produced, the more money they're making per car. Higher profit margin means more profit for the company's output.

Profitable Business

In a bull market, investors have a higher risk appetite for companies that are unprofitable. Spotify is an example of a company teetering on the edge of profitability. In Q3 2023, they reported a profitable quarter for the first time in a year. After earnings, the stock ran up +10%. It's looking promising for them to reach profitability but there is more risk waiting for that to happen than to own a business that's already profitable. However, if you get in before a business turns profitable and they succeed, you'll reap more gains.

Partnerships

Disney recently announced an unexpected partnership with Epic Games. They are investing $1.5 billion for a stake in Epic. It could be a source of growth down the road that is not yet baked into the stock price. Epic has Fortnite, the most popular video game in recent years and a strong community behind it that could spur growth for Disney. Likewise, Microsoft gained extra wind in its sails due to its partnership investing $10 billion in OpenAI. On top of that, they can integrate OpenAI's ChatGPT into their product suite and Bing search engine. This shows how strategic partnerships can give a company a shot in the arm.

Forward Guidance Raised for Key Metrics

Guidance can sway the sentiment of investors. Beating the guidance for earnings per share and revenue is generally seen as positive. The context of the guidance from the company management is important. Did they give soft guidance becuase of unseen supply chain issues or macroeconomic conditions? If so, beating the guidance means less. When the guidance is strong and the company "beats and raises" guidance, it's bullish for a stock. Giving soft guidance in order to smash future reports is also known as "sandbagging". You need to be vigilant to make sure the company you own is not sandbagging its guidance.

Industry Key Performance Indicator

In Q3 2023, Google turned in a seemingly solid report. However, the stock went -10% after earnings. Why? From reading sentiment online, the stock went down because the company missed their guidance on cloud growth. The cloud growth metric has an outsized impact on Google's earnings. In that quarter, they were penalized for missing. For social media or gaming platforms, monthly active users (MAUs) have outsized importance.

Management Shake-up

This catalyst can be positive or negative, depending on the perceived state of the current management. Positions like the CEO, Chief Executive Officer, have outsized importance in the management of the company. If investors think the CEO is valuable to the company, the news that they are stepping down can drive the stock down. Conversely, if a CEO is perceived as weak, bringing in a new CEO can be a positive catalyst.

Catalysts Already Priced Into the Stock

Sometimes, all the good news is priced in. Stocks with momentum tend to run up heading into an earnings report in anticipation. If the report underwhelms and doesn't show any new catalysts, the stock price may deflate after earnings.

Conclusion

With some luck and skill, the "houses" you own will have strong foundations that will sustain growing income for many years. These are some things to watch for when a company you own reports earnings. It is seemingly impossible to understand why a stock moons or tanks after earnings, good luck!

Disclosure: Not financial advice. The author holds stock in the companies mentioned.

Dec 16, 2023

In this life, there are essentially 3 ways to earn a living:

1. run a business or sell something and reap profits

2. own assets that appreciate in value (real estate, land, bonds, fixed income or stocks)

3. become employed, trade your time for money

Trading your time for money is part of the human experience. Since the dawn of modern civilization, humans have collaborated in an economy of goods and services. The industries and technologies deployed have changed, but employment is still a trade of human time or assets

for money in the capitalist world.

We should be selective of when we trade our time. It is probably our most valuable asset, more valuable than large sums of money. A lot of money without time is less than some money with time to enjoy it.

Generated with Bing Image Creator

Employment is the application of your time resource. When searching for your next trade, taking more time to consider different options is worth it. We don't always have the luxury

to pass on a job offer. The best outcome is a job that fits you better, challenges you,

provides new opportunities, improves your skills and sets you up for success.

Be selective but as the saying goes, "don't let great get in the way of good".

Sometimes a mediocre or undesirable job can give you momentum, new contacts, short term cash flow,

skills or a resume booster.

If you're getting paid well but not challenged by the work or demotivated and burnt out from it, is that a good trade? Is the job also draining a lot of your energy? With a job, extra stresses and baggage tend to pile up over time. Is the trade worth the mental strain of holding the job? There could be a better opportunity that accelerates you in the direction you want rather than stagnating it.

Generated with Bing Image Creator

Your labor is an exchange of your time for money or other resources.

You have a set of skills and competencies to deliver outcomes to a company.

Your "career" is the trades you'll make with businesses or directly with

people over the course of your lifetime. Some trades will work out really well

and last many years. Others will only be shorter stints that merely set you up for

the next gig or keep you afloat for awhile. A good trade returns stability, opportunities, education and money at a lower cost to your hours worked and sanity. Make good trades and go smoothly in life.

Oct 30, 2023

Ask 10 people if a stock is a good investment. You'll probably get some stories of why they wouldn't invest, past trades, losses, small gains or just indifference. Someone will probably be holding the stock if it's one of the popular blue chips. What you hear might also depend where the stock stands in the macroeconomic environment and how well they've been running the business lately.

For example, if you asked someone about Anheuser-Busch InBev (BUD) earlier this year, you'd probably hear

about their recent marketing fiascos which led to boycotts of their best-selling beer.

If you asked a shareholder about Tesla (TSLA) last year, they'd probably have mentioned Elon Musk is selling shares to buy Twitter. If they did their research, they'd know in 2022 that Tesla was crushing its vehicle delivery targets.

Last year, the story around Netflix (NFLX) shifted. They reported a decrease in subscribers

in their quarterly results for the first time in years.

Facebook dba Meta (META) was bloated with costs a year ago and the stock price showed the pain. The company overextended itself and had too many employees and diverging ambitions spreading it too thin. In times of perceived economic weakness, companies' ad budgets are often slashed.

Fast forward a year later and most of these stocks are doing fine. In late 2022,

the prices of each of these companies contracted, due to market conditions but also based on their perceived strength in their ability to meet investors' expectations. Of course, the bear narratives were blasted across the internet. So what changed since then for these companies?

Meta (META), lead by Mark Zuckerburg, successfully embraced cost cutting measures like

laying off employees and limiting investment in the Metaverse. In 2023 quarterly earnings reports, the bottom line showed better and leaner earnings. It bottomed below $100 in 2022. Wall Street bought the stock hand over fist after seeing the company's stronger earnings and renewed focus. Still kicking myself for not recognizing this opportunity.

To combat its growth woes, Netflix introduced a new subscription tier with ads. In the following quarters, the stock price rebounded from under $200 and now sits above $400 after its most recent earnings report. I regrettably sold a few shares at a loss near the bottom.

However, the lesson learned is valuable. Companies will have bad quarters. They will miss expectations sometimes. If it's a good stock, it won't derail the overall narrative

around the company. In the end, I profited about $400 on my Netflix trade despite selling a few shares for a loss. But I could still be sitting on a few shares if I hadn't begun to doubt the growth narrative.

Anheuser-Busch is still trying to shake off its poor Marketing moves after a misguided campaign

that invoked negative political discourse. I don't think it changes the business fundamentals although the damage to its Bud Light beer brand seems irreparable. Or maybe people will move on eventually. Regardless, it hasn't moved the stock price. Maybe people will always reach for that light beer, who cares what kind?

Tesla has rebounded this year also from the overhang of Musk's Twitter purchase. This year, the stock is up 100% but it's not all roses. The company is now in the midst of a slowdown since buying a new car usually requires a loan. Thanks to the Fed and its ongoing assault against inflation, the monthly payments for new cars are much more expensive than 2-3 years ago.

Until macro conditions improve, it's going to be tough sledding for us investors.

The cycles of business worked in Tesla's favor up until 2022. Tesla has lowered the prices of its cars to increase its sales, a tactic that boosted demand in the past year. This is another example of the levers a company can pull to meet its goals. By changing prices, or extending their product offering a company controls its destiny. Tesla also is extending its product offering with the roll-out of Cybertruck. Deliveries are promised to begin next month, but Musk mentioned on the most recent earnings call it won't contribute to their bottom line meaningfully until 12-18 months down the road.

The Fed's interest rate increase is also weighing on my investments in solar energy, an industry which finds itself in a similar situation as Tesla's automotive loans. I believe

in the long term story for solar energy. In the short term, if someone wants to install a solar system on their roof or property, it's more expensive to take out the loan. Such is the cyclicality of business. From quarter to quarter, unexpected problems or geopolitical and macroeconomic conditions can surface that challenge a company's ability to hit its targets. As an investor, we need to clearly assess, "Given the recent turbulence, what are the implications for this stock's future success?"

One bad quarter won't sink a company. A few bad quarters won't either. A few bad years won't either, just look at Microsoft (MSFT) from 1999 to 2016. Its price bounced around $50 in this span. During this time it gained a reputation for being dead money to investors because it had done poorly for so long. However, Microsoft rapidly improved its ability to generate cash and innovated on its products. Today, it is one of the world's greatest tech companies. You would have a multi-bagger on your hands if you jumped into Microsoft 10 years ago when it was

left for dead by Wall Street. Wall Street's loss has now become my gain. Although I didn't get in until 2020, I am now happily long a bag of Microsoft shares with a broad knowledge of their business and hands on experience with many of their products. But even the strongest of companies will succumb to the inevitable up and down cycles of business.

These past few years have been loaded with investing lessons. Don't get spooked out of an investment when a company reports a rough quarter or two. In the case of Netflix,

of course they changed their product offering to boost their subscribers after I sold.

The stock's price fundamentals were based on growth and they took measures to restore their subscriber growth to beat Wall Street's expectations. I never imagined they would roll out an ads-based subscription tier. This is an example where the short term speculation for a stock was based on outdated information. Netflix extended its product offering to boost

its subscribers.

Additionally, the cost of borrowing money affects many goods and services. If a loan is required for someone to buy a company's product, it will thrive in times when money is cheap and stagnate when money becomes expensive. When the fed jacked up interest rates to 5-7%, they shifted the flow of money in the economy. They do this in the name of battling inflation. I wish I had learned this earlier. I had only seen the economy churning in a low interest rate environment for all of my adult life. I've been learning the hard way what an impact these rates can have on investing outcomes and business sales.

In conclusion, cyclicality is not the enemy. It will influence the price of all stocks. Sometimes it will work in your favor. However, sometimes demand can be pulled forward due to external conditions and create "boom or bust" quarters. The pandemic is a perfect example. In 2020 and 2021, we enjoyed the boom times. The quarters since then have been tough on investors, but in general earnings reports seem to be improving. Some companies were doing record business during the pandemic, short-term phenomena. When it happens to be a good quarter, don't always assume the good times will continue rolling. When it goes the other direction, don't panic. It's easier said than done. Above all, trust your conviction. Read the signs for the company's long term health. If you don't have conviction to hold, that's your decision and one we all can understand. None of us know what will happen anyways.

Stocks trade on momentum and the market reacts to their earnings from quarter to quarter. A company that misses earnings estimates or key metrics will cause concern among investors. Sometimes there is simply nothing that can be done to avoid the cycles of business. My suggestion is to develop a thicker skin to hold on and clear thinking to assess if things are really going bad, or if it's just the cyclicality of the business and economy.

Disclaimer: This blog is not financial advice. Some companies mentioned are held by the author.

Oct 19, 2023

Lately there has been a discourse online about the problems with dividend stocks. In the past, dividend stocks have held more favor with investors. I find it interesting that recently they've been cast as questionable investment for the long term investor. So what's wrong with getting a cash dividend back from your investments? The market seemed to be selling off these assets in the summer months of 2023. I think this is proof that all the critics come out of the woodwork when a stock's price is trending down.

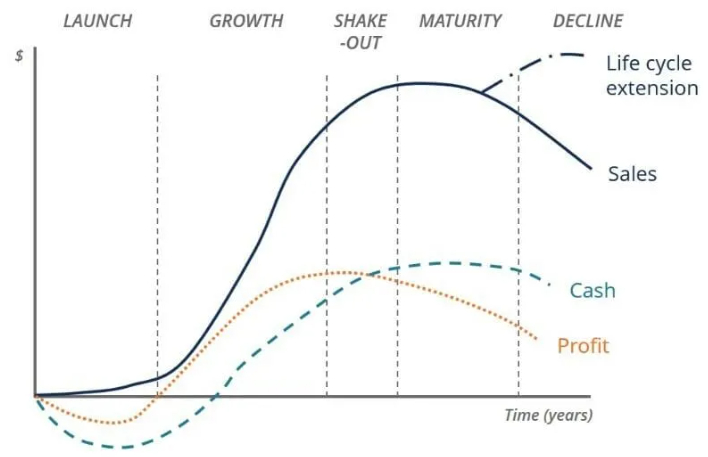

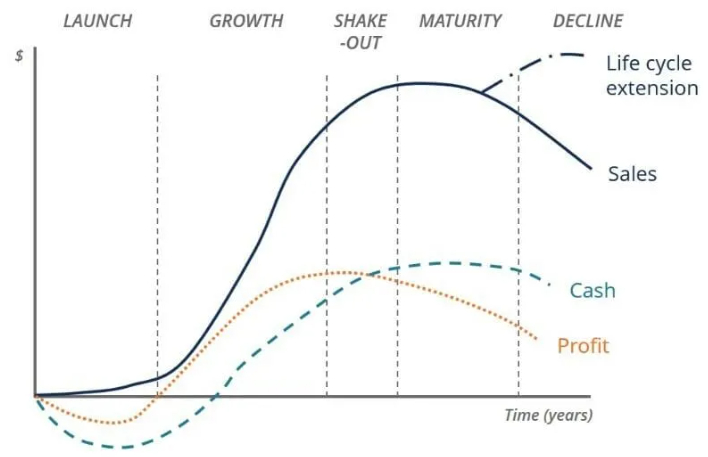

The thinking is that when a company returns money to its owners, it's a last resort. The company is saying, "We have nothing better to do with this cash pile, so let's give it back it to our shareholders." It's a win-win situation, right? Kind of. Growth stock zealots are quick to point out that the money returned to the company's owners will deflate the stock price in the long run. I guess this is true. Instead of a dividend, a company can also choose to "buy back" its own stock instead, raising the price for shareholders without incurring any taxes. They could also invest in their business to increase future profits. Dividends are seen as characteristic of a business that is in its "declining corporation" phase, rather than its "wait until you see what we're going to do in the future" phase.

source, Corporate Finance Institute: https://corporatefinanceinstitute.com/resources/valuation/business-life-cycle/

At the moment, 22% of my savings is allocated into dividend-paying ETFs, mutual funds or stocks. According to Google Finance, my taxable portfolio and self-contributed IRA contain 8% medium dividend investments and 31% high P/E (price to earnings) investments. A stock's higher price to earnings ratio indicates it is trading at a multiple of its current earnings and is more likely associated with traditional growth stocks. You have to pay a higher multiple to gain the income streams of these high P/E businesses. I want to invest more into dividend stocks to raise my passive income level. Currently I earn around $50/month from my investments. Most of this is automatically reinvested.

You get to choose if you want to reinvest your dividends or take them as cash in your pocket. If you take it in cash, you'll need to pay a tax. If you use it to buy more shares automatically, you'll still need to pay a tax. So either way, part of your dividends are going to the government. If you hold foreign assets that pay dividends, the tax gets taken out of your payment before you receive it.

Not all dividends are the same. Yahoo Finance is great for researching dividend yields. It lists the forward dividend & yield of every stock if it pays a dividend. For example, Ford (4.98% yield) and Coca-Cola (3.40%) each yield a larger dividend so I've been scooping up shares. I believe these businesses are rock solid. Thanks to the dividend stock summer sale, they have pulled back from their all-time highs. I'm betting they will still be thriving 30 years from now. Hopefully, their yield will boost my passive income along the way if needed. I like having the option to turn off drip investing and flip them to cash if I need some extra money. Their prices also tend to be more stable. Whereas a growth stock needs to continue its trajectory of growth in order to justify its price to earnings multiples. If the economy slows down, they might suffer.

A 3-6% dividend yield is seen as a "goldlocks zone" of dividends. Anything higher than that might be a "value trap", luring in yield chasers to a owning a business with questionable fundamentals. If you are paid a whopping dividend but the price of your shares is decreasing, it offsets your returns. It may not be the best move to invest, despite reaping these giant yields.

Age is a factor to consider how much you want to commit to dividend versus growth stocks. I'm 33 years old, so I likely have an easy 20-30 years before I'd want to use my invested money, barring emergencies or large purchases where I need to raise cash. If you're younger, the growth stock enthusiasts say you should be more oriented for long term growth.

There's also the concept of a hybrid "dividend growth" stock. Microsoft (0.90%), Apple (0.54%) and Nvidia (0.04%) are examples of companies with higher P/E ratios that are rapidly growing their business and pay a smaller dividend than Coke or Ford. These types of companies are a happy medium between dividend and growth in my opinion.

In conclusion, I propose that a mix of dividend and growth stocks is the best approach to investing. Like most things in life, it's not all-or-nothing. Your allocation depends on your financial goals, risk tolerance, salary and age. If your salary is comfortable, you may not need to worry about passive income and can re-invest your cash payouts. If you're unemployed, you can use dividends to spell your expenses. Later in life, you might be lucky enough to live off your dividends. I hope to get there someday!

Oct 09, 2023

One of the hardest parts of investing is not doing anything at all. You need to wait for your investments to compound over time. The problem is the narratives that surround your investments. Adding more uncertainty, unexpected "black swan" events like wars and COVID can scare investors into thinking they know what's going to happen next.

I am not against actively managing your portfolio. Sometimes, we need to consider new information that changes our theory for why something will be a solid investment. For example, if a company is hemorrhaging money and not showing any signs they will turn it around. But there's still a chance they might figure it out some years down the road.

There is a gray area of investing where risk meets reward. You can choose to stick with an underperformer. If the company eventually dominates their sector and takes market share, leading to profits then you'll be rewarded. More risk, more reward. I personally like to include a few speculative plays in my portfolio, but honestly it doesn't ease your nerves to watch a company you own struggle to reach profitability.

My most profitable investment that I'm still holding, Tesla, falls into this category. I thought the world was destined to have an electric vehicle future before many saw the writing on the wall. Before the company turned profitable, I bought a bag of shares with intent to hold for a long time. Luckily, they turned their first annual profit in 2020 and continue to improve their results.

So far, the EV theory has paid well and the electric vehicle movement shows no signs of stopping. This story is an example of how you can invest on what you think the world will look like in the future, even if the situation is questionable in the present moment. Just know that it might take longer than you think to play out, or you could be wrong and it never plays out. The friction of this uncertainty in the outcome is what makes investing hard. Sometimes, there are simply better options to reallocate your losses into another more promising company that already has established a sound balance sheet.

I propose that many times, but not always, the best action is not to make any moves. You've got a large unrealized loss, but how do you know that market volatility won't swing the other way on your position? If you believe the company will be important in the future, hold.

Investing is tough because it's easy to be convinced by a stranger or talking head online that they know what's going to happen. More often than not, it's best to play the waiting game. Extend your holding period and the likelihood you'll profit increases.

Aug 09, 2023

Small bets can have outsized returns. If it goes south, you've also got less on the line. Have conviction? Make a larger bet. Not sure about an investment? That's a solid candidate for a small bet. You find out the company's outlook is now questionable or management is not meeting the mark? You could always sell half. However, the largest gains come from letting asset value compound over time.

The size of your bankroll determines your range. Consider making some small bets in stocks, real estate or even starting a business.

There is less stress in a small bet. For me, it's $50-$500 up to $1,000 that I consider a "small bet" in my taxable investor brokerage account. Anything greater than that and it's no longer a "small bet" to me.

I even have some $50 or $100 positions that I might add to someday. This is the magic of stocks. Value tends to go up over time. You could have bought almost any stock at the end of 2022 and would riding gains. At the time, no one knew what would happen.

Now, the general outlook for stocks seems favorable, with consensus that the recession is cancelled. Year to date, the market is mostly reacting in a way that suggests we were in the "oversold" range at the end of last year. Are we now overbought? I doubt it, but we'll see! My theory is that now is a still a decent time to open some small bets to gain exposure to exceptional asset value growth.

My portfolio is tech heavy with some strategic industries like electric vehicles, solar energy and cloud computing. I also reaped some of the sudden 2023 AI buzz in Tesla, Microsoft and Nvidia with tech prices getting a lift pretty much across the board.

Microsoft is a core position in my portfolio. Nvidia was a medium sized bet that resulted in a 3x bagger gain. It's now a small bet again after I took some profits. Even on a small bet, booking 3x your money is a pleasant payday. After making the original bet in 2020, I'm letting my $1000 cost basis ride in this stock.

It's hard to encourage anyone to get into a high multiple valuation. I say that knowing this semiconductor company is a one of my best small bets currently. Risky or frothy prices might be right for a tiny bet with the possiblity of adding more later on a dip. Sometimes it pays to buy a company on such a trajectory but it honestly scares me to buy it now. So I'm holding my small Nvidia bet for a long time.

Afterword

This is not financial advice nor all writing on this blog. Learn to assess the health of a business. It is an art based on valuation, cash flow, profits, management, margins, market share, strategy, reinvesting assets for compounding growth and so on. Investing is unpredictable and risky, sure, but make some small bets.

May 13, 2023

I'm an advocate for "buy and hold" investing, meaning if you are making an investment it should be for a long period of time before selling. However, you may need to cut a position due to a company's failure to turn a profit or dependency on bending public policies to their favor. This was the case with LYFT, based in California, the battleground of workers rights that shifted over the years as ridesharing went mainstream.

I saw a game-changing service to society helping people get where they needed to go. I also moonlighted as a LYFT driver for a few months in 2017, seeing first-hand how they onboarded drivers. LYFT filed an IPO in March 2019. I had $2,600 to invest and wanted a piece of those huge ridesharing profits that were going to happen someday. In retrospect, this was too speculative of an investment. LYFT was growing riders, but profitability hadn't been proven yet. Being in my 20s, I was just starting to invest and eager to start buying stocks with the extra money I had.

I paid $65 per share for LYFT shortly after its IPO (Initial Public Offering) in 2019, under the IPO price of $72. Another lesson from this trade is that it more risky to buy an IPO close to its debut in public trading. But I couldn't resist so I put it on LYFT shares.

Another thing I learned from holding LYFT stock is to consider the risk of political impacts on your stocks. In the case of LYFT, they and UBER were typically involved in regulatory battles with the state of California over the classification of their drivers in the past 10 years. Are rideshare driver independent contractors? The debate continues. And each time it blew up on the news, I looked at those shares and thought... I signed up for this? Court battles. A questionable public image and an unprofitable business to boot. Having tried LYFT's rideshare services myself, I thought their culture was strong and they'd be a leader in a promising new industry. We'll see if they ever make it.

source, Bing: https://www.bing.com/search?q=lyft+stock

They closed around $8 per share yesterday. My investment? Within the first year, I was already down considerably and endured several painful earnings reports. They were nearly profitable, but then were hit hard by pandemic lockdown. I sold out from 2021 to 2022, selling each share at a loss. 90% of the shares were sold in June to October 2021 near the end of the most recent bull market. Only with hindsight, can I now say I feel strongly it was the right call. If I had left the money there, I'd be sitting on $375 in market value in Lyft and over $2,000 of unrealized losses.

I sold the position incrementally, ranging from $38 - $63 per share. I sold my last 5 shares at $38 per share in Feb. 2022. Having cleared the position, I now know from experience, there are times when you should cut your losses. In total, I limited the damage to $546 lost and re-allocated the remaining $2K to other investments.

Looking at LYFT in 2023, it's down 89% over the past 5 years, unprofitable with a real possibility of bankruptcy. Recently, the founders have stepped back from operating the company. They're also low-key saying they're open to a buyout. Maybe they will turn it around, but I'm no longer on the hook for a few grand if they don't. I now try to buy companies that have already established profitability and growing. This is my LYFT story, may we all stay away from such investments and realize quickly if we've miscalculated.

May 11, 2023

A market of stocks reminds me of a school of fish. They swarm in the same general motion, sometimes using their collective to protect each individual fish with natural deception. Some of the fish are stonger than others, use their competitive advantage to survive and help the other fish. But if a fish becomes too weak, it gets eaten. Same with stocks.

In January 2022, the stock market was bubbling up together in a cash injected, inflation-fueled blow-out. Then the direction of the tide shifted. After pulling back strongly into summer, a brief respite in July before getting hammered even more, with a possible bottom reached in late December. Warren Buffett once said, "Only when the tide goes out, do you learn who has been swimming naked." It's the weaker companies burning through cash struggling to survive. They get metaphorically eaten. Thankfully, stocks are starting to bounce back. It's now a "stock picker's market" or so I've heard. If you bought anything in December, you're probably up a decent amount on the investment. In a few cases, my new positions and DCA buys from within the past 6 months are up 80%. Of course, I'm still down 30%-60% or [gasp] more on too many positions. Regardless, I tend to buy and hold with an option to sell at breakeven if I don't like the company's power structure or earnings reports. I can wait a long time and intend to do so with all my stocks. Sidebar: did you know whales can live up to 90 years? They're probably good investors.

Like fish, stocks valuations are loosely tied together, especially at an industry level. If prices go up a lot, they'll probably reverse eventually. If they recently pulled back hard, there is a better chance for growth at a reasonable price. Sometimes you have to load up when a stock is down over 20% in a single day. When all hope is lost, yet another regression but this time upwards after you bought it if you chose well. It's not always going to work out, but lowering your cost average is generally considered a good idea in investing.

Nevertheless, no one really knows what the market will do. The stock market's short-term direction is about as random as a school of fish. When the market regresses to the mean and sells off: buy the fish that is consistently makes the right moves. It has these characteristics: quickly acquires customers and keeps them, protects or grows their product profit margin, survives economic drawdowns, socially responsible and guides earnings appropriately. That's a catch!

Apr 22, 2023

This post summarizes ways that I keep tabs on the companies I'm holding in my investment portfolio. I tend to hold stocks for a long time, regardless of stock price movements. It helps to see the whole picture, industry, customer mentality and metrics like free cash flow and profits. These are ways I try to glean insights into a company's future potential or lack thereof.

Here are 10 ways I keep up with my stocks:

- Use a Charles Schwab investor checking account to buy assets + make trades.

- Watch CNBC for free in the Charles Schwab mobile app.

- Track dividends received in Charles Schwab account.

- Use Google Finance to manage watchlists and monitor daily prices. Schwab also has a watchlist but I prefer Google Finance's UI for watching short term price movements.

- Observe the company "in the wild".

- If public, visit the company and observe what you see. Is it a well run operation? Are customers happy?

- Note the frequency you see people choosing the company's products day to day.

- Bonus points if you are the customer, you know intimately what value the company is creating.

- Earnings calls: listen to the call live or most companies post the call transcript online.

- Read investing blogs and books from the greats. I subscribe to my followed blogs via an RSS feed. Here are a few I recommend:

- Monitor sentiment with Twitter and Reddit. Read the Twitter cashtags for individual stocks and browse social media for overall sentiment monitoring. Beware there are emotional posters with an agenda, opinion or position that may contradict yours. I find it useful for gaining a sense of general feelings about the market or shares in a company.

- Use finance Python libraries, like yfinance to see more complex financial calculation about a stock. I wrote in depth about the endless tools you can apply for financial calculation here on my other blog.

- Talk to people about their investments. What are they investing in? What's working for them? What are they excited about? They have a perspective that differs from yours that exposes you to a new concept or industry.

Mar 20, 2023

In March 2023, I achieved a new milestone of passive investing. Since beginning in 2018 with approximately $15,000 in savings, I've accrued a six figure portfolio of funds and stocks with a "DCA and buy and hold" long term mentality. I did this by holding a full time job and earning multiple pay increases along the way.

About 50% of my retirement funds are in a managed employer match 401(k) with a different bank. My primary bank is Charles Schwab. Most of my self-directed IRA is collecting dividends with Schwab index funds (SCHB, SWPPX and SWTSX) and MSFT. My self directed IRA has a smaller weight of non-dividend growth stocks also. In my taxable portfolio, the core dividend earners are stocks like MSFT, NKE, AAPL, F and NVDA.

Additionally, 3-5% of my investment portfolio is committed to cryptocurrency assets. After buying incrementally from December 2020 to 2022, I now have market value exceeding $5,500 staked in Ethereum. Approximately 60% of my crypto portfolio is in ETH, followed by 25% Bitcoin, which does not have a staking protocol. Over the past 7 months, my staking rewards netted me $12.48 per month by my calculations.

Passive Investing Income Breakdown

Stock Dividends: $38/month

Ethereum Staking: $12.48/month

Combined, they add up to a investment income of $50/month and counting with time. Hold dividend stocks and index funds. Stake Ethereum, if you can handle elevated risk that surrounds crypto. Then again, with the recent banking shakeout, maybe a more decentralized store of value is intriguing. Find a job or start a business, keep saving and reap the rewards of investing. This is how I achieved a new level of passive income. In both, their dividends are automatically re-invested.

This post and all posts on this blog are not financial advice. All investment decisions have personal risk and you should assess them thoroughly before taking any financial actions.